At Accurate Insurance we believe that every motorist on our roads and highways should be familiar with Illinois minimum auto insurance requirements, including uninsured motorist coverage.

Uninsured Motorist Coverage

Typically, when you’re in an accident and the other driver is at fault, their auto liability coverage would help pay for your medical bills or repairs to your car. But if that driver doesn’t have auto insurance, you may have to pay those expenses yourself.

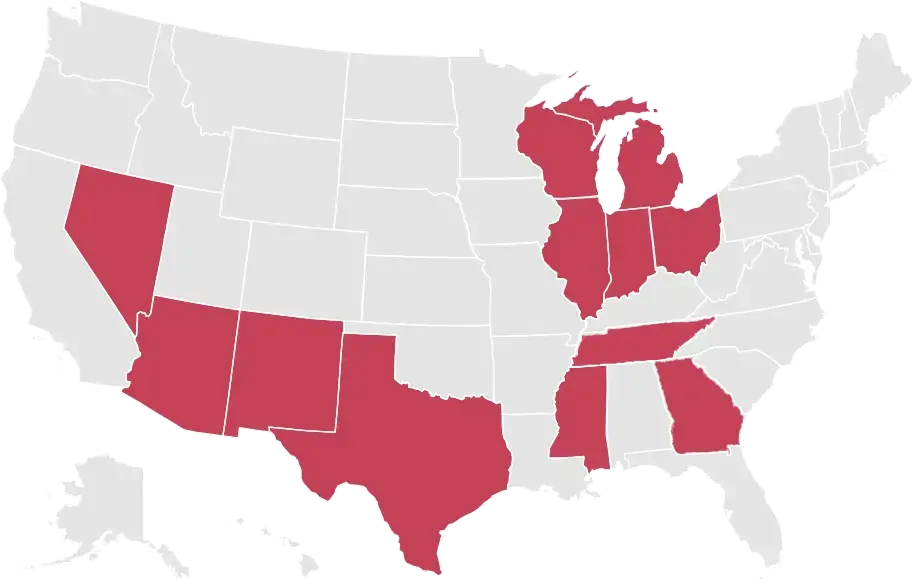

Unfortunately, Illinois has a substantial number of drivers who are not insured. The Insurance Information Institute recently found that about 1.7 million Illinois drivers have no auto insurance, putting others at risk because of their lack of insurance coverage.

Because of this risk, Illinois law requires you to have uninsured motorist coverage as part of your auto insurance policy.

Typically, What Does It Cover?

Uninsured motorist coverage may offer two types of protection.

- Bodily injury coverage helps pay for your medical expenses resulting from a crash caused by an uninsured driver.

- Property damage coverage helps pay for repairs to your vehicle after a crash caused by an uninsured driver.

Underinsured Motorists

In addition to uninsured motorists, other drivers are underinsured. This means that while they have liability insurance, their liability limits are not enough to cover your bills after an accident, or their liability limits are less than or equal to your uninsured motorist coverage limits.

Illinois Requirements

Under Illinois law, you are required to purchase both uninsured and underinsured bodily injury coverage as part of your auto insurance policy, and you have three choices:

- Select uninsured motorist coverage limits equal to your Bodily Injury Liability coverage limits. These limits are $25,000 per person and $50,000 per accident. If you select limits greater than $25,000/$50,000, your policy will automatically include underinsured motorist coverage.

- Select the minimum uninsured motorist overage of $25,000/$50,000, but this will not include underinsured motorist coverage.

- Select in writing uninsured motorist coverage less than the $25,000/$50,000 Bodily Injury Liability limits.

Note that in Illinois you’re not required to purchase uninsured motorist property damage coverage, only bodily injury coverage.

Here to Help You

We know all these Illinois minimum auto insurance requirements and choices can be confusing, and we’re here to assist you. Call Accurate Insurance today at 1-800-999-1034, and let us help you get the auto coverage that’s right for you.