Need an SR-22 certificate, but don’t know where to start? Accurate Auto Insurance is here to help. Our car insurance company will ensure your SR-22 is filed correctly and that you find an affordable policy that suits your needs.

Our team makes the process easy. If the court has ordered you to carry an SR-22, simply fill in your zip code above to get started. We’ll take care of the rest.

We understand most people have never heard of SR-22 insurance, at least not until they are required to carry it for themselves. For this reason, we want to help you understand what it is and why you need it, as well as how to get the best deal on your car insurance policy.

What is an SR-22 Certificate?

An SR-22 certificate is a court or state-ordered document which proves you have the minimum required insurance coverage to drive. For example, a person may be required to submit an SR-22 certificate in order to regain their right to drive after their license has been suspended or revoked.

SR-22 certifications are used in almost every state to ensure high-risk drivers meet minimum liability coverage requirements. An SR-22 certificate is also referred to as a Certificate of Financial Responsibility. This is because an active auto insurance policy covers the driver’s liability to others who may be involved in a future accident.

Do I Need SR-22 Insurance?

Not all drivers need to file an SR-22 form or obtain an SR-22 insurance policy. These measures are reserved for people who have been deemed high-risk drivers.

You may be considered a high-risk driver if you:

- Have a suspended or revoked license

- Have previously driven without insurance or a valid license

- Have a DUI conviction or another serious traffic violation

- Had an at-fault accident while driving without insurance

- Have obtained multiple traffic offenses or tickets in a short period of time

If you’re required to get SR-22 insurance, the court or state will notify you directly. Most commonly, the judge will tell you if you need to carry SR-22 insurance during your court proceedings. In some cases, you may need SR-22 car insurance to get your driver’s license reinstated.

If you’ve been court-ordered to carry SR-22 compliant insurance, it’s important to obtain the right coverage as soon as possible. Failing to comply with the order can have serious consequences, so it’s best to act quickly.

Accurate Auto Insurance is well-versed in SR-22 compliance, and we can help you find the coverage you need at an affordable price. Best of all, you can get a quote in just minutes! Call us today at 800-999-1034 for a free, no-obligation auto insurance quote.

Why Choose Accurate Auto Insurance for SR-22?

All Driving Records Welcome

As an experienced provider of SR-22 insurance, we’ve seen the full range of driving records. We believe that a person’s driving record shouldn’t exclude them from accessing affordable SR-22 insurance. We welcome all drivers to apply for an instant quote on our website.

No Credit Check Required

Our application process does not require a credit check. This allows us to reach as many customers as possible and offer them affordable rates, no matter what their current or past financial situation is. We’ll help you find a policy with an insurance premium you can afford.

How Can I Get an SR-22 Certificate?

Accurate Auto Insurance makes getting an SR-22 certificate easy! Simply call our team at 800-999-1034 or enter your zip code at the top of this page to get started!

If you have an existing auto policy, we’ll work with your insurance company to ensure that the necessary SR-22 form is filed with your state’s Department of Motor Vehicles (DMV). This helps ensure that you can get your license restored as quickly as possible.

When Does My SR-22 Expire?

Your SR-22 will last for as long as you have insurance coverage. Most states require you to carry an SR-22 certificate for at least 3 years, but this timeframe may vary. Once you’ve carried SR-22 auto insurance for that amount of time, your state or court-ordered insurance requirements will expire. Once that period is over, you will be able to purchase and hold a standard, lower-cost insurance policy.

If your policy lapses or you cancel your insurance, your auto insurance company is required to notify the state immediately. This can lead to license suspension or other penalties. This is why it’s important to maintain consistent insurance coverage until your SR-22 expires.

Find Cheap SR22 Near Me

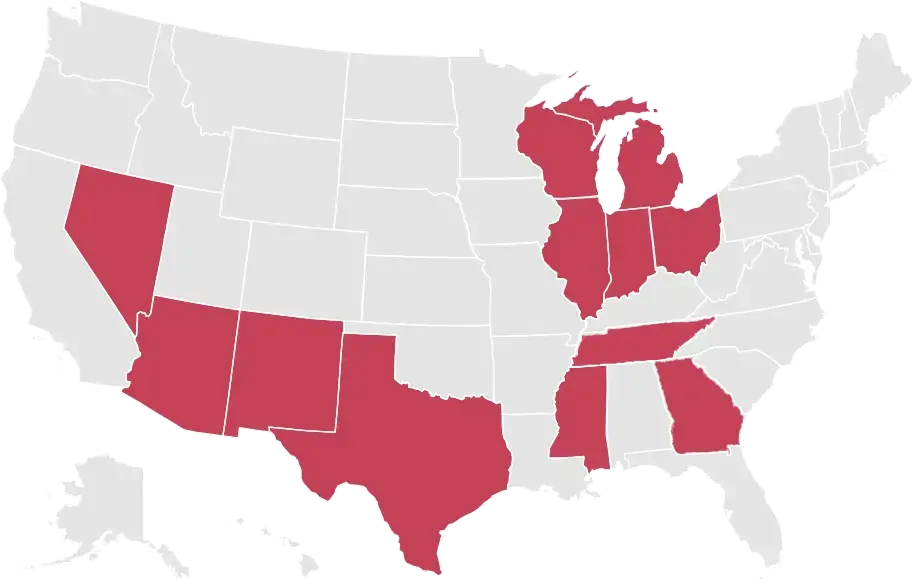

If you’re looking for affordable SR-22 insurance, turn to the experts at Accurate Auto Insurance. We have experience finding affordable insurance across multiple states and counties. We’ll help you keep your insurance costs down so that you can spend more on what matters most.

Call our team at 800-999-1034 or enter your zip code at the top of this page to get started!