When it comes to navigating the aftermath of a serious traffic violation, understanding SR22 insurance is crucial. Though commonly referred to as a type of insurance, an SR22 is actually a certificate that proves a driver carries the minimum required insurance coverage after certain traffic incidents. Accurate Auto Insurance makes it easy to obtain SR22 insurance at an affordable rate.

Who Needs SR22 Insurance?

Not everyone will need to get SR22 insurance. This certificate is typically required for drivers who have committed serious traffic offenses such as DUI convictions, reckless driving, or driving without insurance. It’s the state’s way of ensuring high-risk drivers maintain proper insurance coverage.

Obtaining SR22 Insurance

Obtaining an SR22 certificate involves contacting an insurance provider who offers SR22 insurance. Once you have secured a policy that meets the state’s minimum auto insurance requirements, your insurer will file an SR22 form with the DMV on your behalf. This form serves as proof of your compliance with the insurance requirements.

Costs and Duration

The costs associated with SR22 insurance vary, including filing fees and potentially higher insurance premiums due to the elevated risk profile of the driver. Typically, drivers are required to maintain SR22 status for about three years, but this can differ based on the severity of the infraction and state laws. Accurate Auto Insurance makes it easy for you to find cost-effective SR22 insurance.

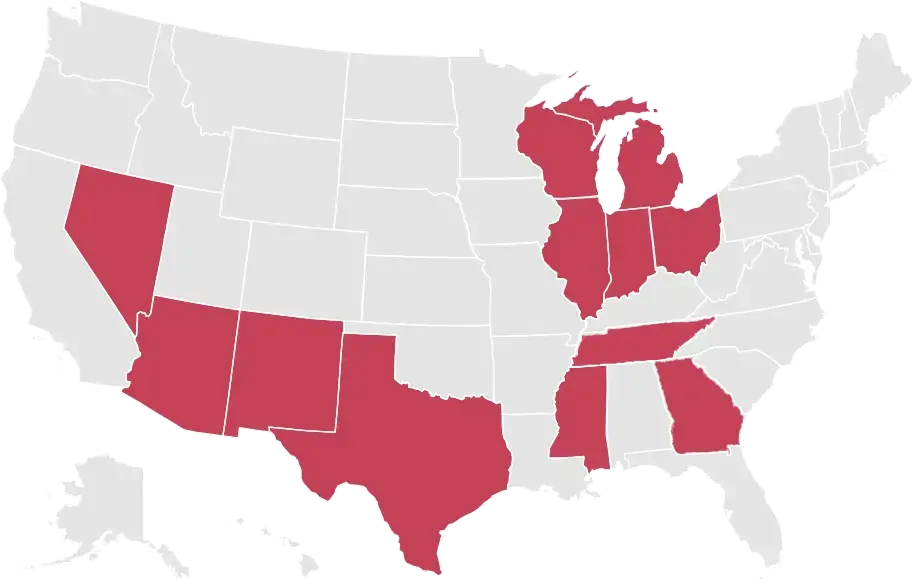

State Variations

SR22 requirements can vary significantly from state to state. Some states may have different forms or certifications similar to the SR22, each with unique rules and duration periods. It’s important to understand your state’s specific requirements for SR22 insurance.

Consequences of Non-Compliance

Failing to maintain SR22 insurance when required can result in severe consequences, such as the suspension of your driver’s license, additional fines, or even jail time. Compliance is critical to ensure you stay on the right side of the law.

The SR22 plays a pivotal role for drivers who need to prove financial responsibility after a serious offense. It is not a path anyone hopes to take, but for those who need to navigate these waters, it is crucial to stay informed and maintain compliance. If you find yourself in need of SR22 certification, contact Accurate Auto Insurance. Our insurance professionals can guide you through the process to get SR22 insurance efficiently and affordably.