Lots of online advice will lead you to believe that there are benefits to not filing a claim with your auto insurance in Peoria after a minor accident. Some sources will tell you that filing claims is just a time-consuming hassle that will raise your premiums. The truth is, when you choose to circumvent the claims system and seek a private settlement with another driver, you put yourself at risk. Today we’ll be discussing the pitfalls of opting for a DIY accident resolution—and the benefits of using the insurance you’ve already paid for.

Underestimating the Damage

So, you’ve had a fender bender. The damage appears to be minor, all cars involved seem to be driving fine, and thankfully everyone is able to walk away from it. But even a minor crash can cause a raised heart rate and a rush of adrenaline. As a way to cope with these sensations, many people will jump to the conclusion that everything is ok. It’s important not to let this impulse overtake your better judgement; you still need to file a claim, and here’s why.

Delayed Pain After an Accident

It’s not uncommon for an impact like a car crash to result in soreness, pain, and injuries that set on some time after everyone has walked away. Failing to take an accident seriously from the start may delay critical medical intervention, resulting in greater pain and suffering later on.

Delayed symptoms of an injury could include:

- Back pain

- Headaches

- Abdominal pain

- Pain in the neck or shoulders

- Numbness or tingling in the limbs

- Emotional pain and suffering (depression, anxiety, or PTSD)

While some of these will fade on their own without serious consequences, several of the symptoms listed above could serve to indicate a very serious injury. For example, an individual may walk away from an accident feeling more or less normal, only to have their mobility threatened by an initially undiscovered spinal injury. Therefore, it’s best to seek out a professional medical opinion and make a claim on your insurance immediately following an accident.

Medical Costs

Depending on the details of your policy, involving your insurance company can help alleviate the financial burden associated with automobile accident injuries. With the seriousness of a physical injury hanging in the balance, it’s best to alert your auto insurance company and make a claim as quickly as possible.

If your coverage has a “med pay” clause, the other driver’s medical bills will be covered up to a specified amount if you are responsible for the accident. Should you be injured, the reverse is true. If you opted for comprehensive collision insurance, your own automobile insurance may provide funding for your own injuries as well. The sooner you alert your insurer, the faster you will have access to the tools you need to recover from your accident.

Improve Your Legal Position

Car accident lawsuits are among the most prevalent types of personal injury lawsuits filed in the United States. If you, the other driver, or any of your passengers develop a medical issue as a result from the collision, a legal suit may soon be on the horizon. If you call your insurance provider immediately following an accident, you give yourself a stronger position from which to respond to—or file—a lawsuit.

First, taking this responsible step provides evidence of your upstanding character, which will help improve how you come across in court. Second, involving your insurer will create firm documentation for every step of the process (your lawyer will thank you). Third, and perhaps most important, you will not be handling the burden of investigating your case alone. Auto insurers specialize in getting the details of an accident and may make recommendations that can help you.

When Not to File an Auto Insurance Claim

If you have liability-only insurance and experience an accident that leaves only your car damaged, there is no need to file a claim. With liability insurance, only cars owned by other people involved in the accident are covered. Even with collision coverage, you may not want to file if your minor accident results in no injuries and only slight damage to your car. Examples could include denting the door while playing 1-on-1 in the driveway or scraping the bumper while pulling out. If you are unsure about filing a claim, it’s best to review the details of your policy.

Auto Insurance in Peoria

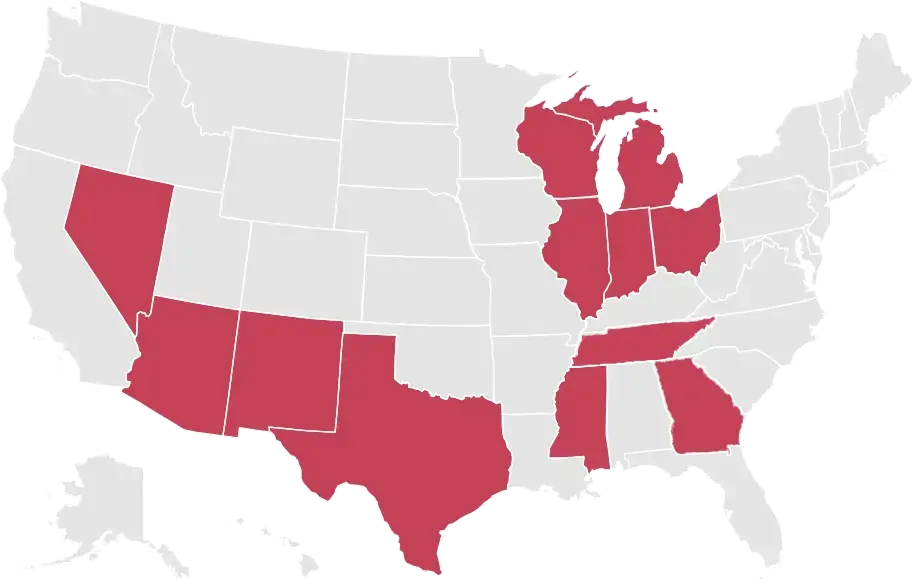

If you are seeking affordable auto insurance in Peoria, IL or near any of our other locations, Accurate Insurance can connect you with the most affordable quotes around. We offer competitive quotes that help get customers back on the road fast with the coverage they need. We also assist those who need motorcycle insurance, Indiana SR-50 insurance, SR-22 certificates, and rideshare insurance. It’s easy to receive an instant quote online or on the phone. We’re here to help, so please do not hesitate to reach out with questions.