Auto gap insurance is insurance you can purchase to cover the “gap” between the cost of repaying your car loan and the amount the insurance company will actually give you for your totaled car. Since a new car depreciates as soon as it leaves the lot, it is already worth less than you owe on it. Even if you were to total your new car the same day you bought it, the money your insurance company will pay out for the car will not likely cover the balance of the loan. Gap insurance is the only way to make sure you will not be in debt after losing your new car.

Gap insurance can sometimes be purchased on newer used cars, where the dealer price of the car still may be significantly higher than an insurance payout would cover. Some insurance companies will only cover brand new cars, however.

So how do you get gap insurance? First ask your current or prospective insurance provider if they can give you gap coverage. Just like you would shop around for your basic auto insurance premium, you may want to shop around for your gap coverage. It is usually very affordable, and worth the extra cost to ensure that you do not end up carless and saddled with thousands of dollars in debt. Some dealers may try to sell you their own auto gap insurance as an add-on, but you can often get a better deal by purchasing this special coverage on your own.

Gap insurance is often required when leasing a car. It the coverage may be included in the lease price, but if not you will need to make sure you are covered. Since you didn’t purchase the car, the dealer will lose money if it is totaled. So they may want repayment from you immediately.

Finally, if you have an older car you are probably not eligible for gap coverage. If you still owe money on your older car, the best thing to do to protect your investment is to drive safely!

Whether or not to purchase gap insurance is a decision only you can make as a car owner, balancing the supplementary insurance premium cost against the potential risk of finding yourself with a totaled car in the future. Like all insurance, you never know when you might need it, but you sure are relieved that you are covered when an accident happens.

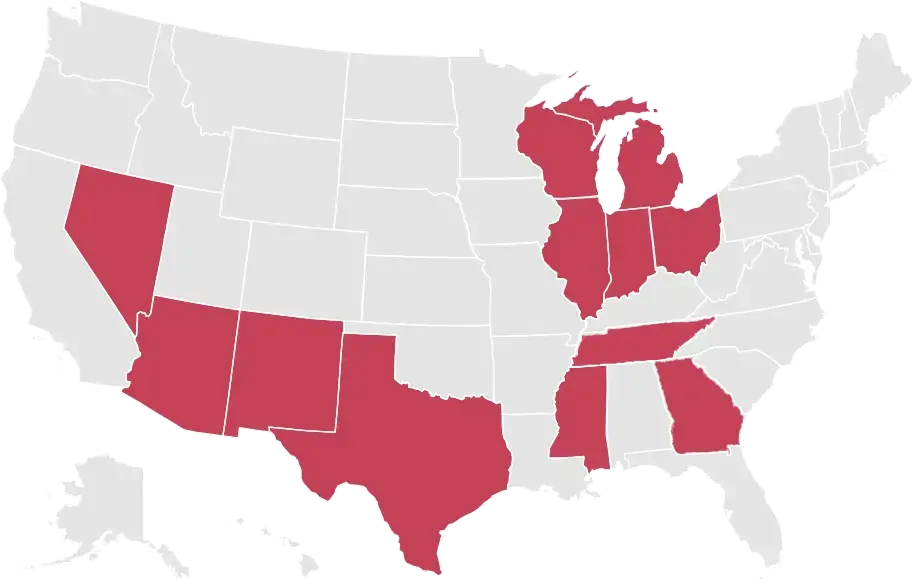

This article is brought to you by Accurate Auto Insurance, where Chicago, Illinois and Indiana drivers get quick, free auto insurance quotes.