What is SR50 in Indiana?

Are you a vehicle owner in Indiana? If so, you might need SR-50 insurance to comply with your state’s financial responsibility laws. Indiana SR-50 insurance is not actually a form of coverage, but a certificate that proves you have the minimum level of insurance legally required to drive in Indiana.

Why is it Required?

We’ve answered the question, What is SR-50 Insurance? Now, you might be asking why and when is SR-50 required by the state?

Drivers who have failed to comply with Indiana’s state minimum coverage requirements may be required to carry SR-50 alongside an Indiana auto insurance policy. High risk drivers may also be required to carry an SR-50 insurance form.

Violations that can result in an SR-50 requirement include:

- The driver has received 3 moving violations within 12 months.

- The driver was caught driving without the state-required minimum level of insurance.

- The driver was charged with a driving-related crime.

- The driver was in an accident/collision that was reported to the Indiana Bureau of Motor Vehicles (BMV).

- The driver was charged with a moving violation while driving on a suspended license, or with no proof of financial responsibility.

The state of Indiana requires drivers to show proof of auto insurance to the Indiana BMV for any moving violation or accident they are involved in, or any request issued by the BMV for proof of insurance.

If you are uninsured at the time of a violation, you will likely be subject to a one-year suspension of driving privileges and a reinstatement fee of up to $300. The Indiana BMV will also require SR-50 to reinstate your license.

Minimum Insurance Requirements in Indiana

An SR-50 form proves to the BMV that a driver has the minimum required level of auto insurance coverage in Indiana. SR-50 must be filed with the BMV by the driver’s insurance company and attached to their current policy.

SR-50 is usually only required for the length of the driver’s current insurance policy, or longer if the BMV dictates it. A driver does not need to file for SR-50 more than once, unless they are involved in another incident which results in an SR-50 requirement.

Indiana’s minimum auto insurance liability coverage requirements are as follows:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage per accident

It should be noted that individuals who are required to file for SR-50 typically face higher car insurance rates. This is because drivers who are considered “high risk” are more likely, in the eyes of insurers, to file insurance claims.

How Much is an SR50 Insurance Certificate?

While there is no SR50 insurance cost, if your license has been suspended in Indiana, you will need to pay license reinstatement fees.

What’s the Difference Between SR-22 and SR-50?

When you compare SR50 VS SR22, there are only a few select differences.

SR22 insurance in Indiana shows proof of current and future insurance coverage, and requires refiling. SR-50 proves that you have current insurance coverage, and only needs to be filed once. The SR-50 form, available on the BMV website, also shows the beginning and ending dates of your existing insurance policy.

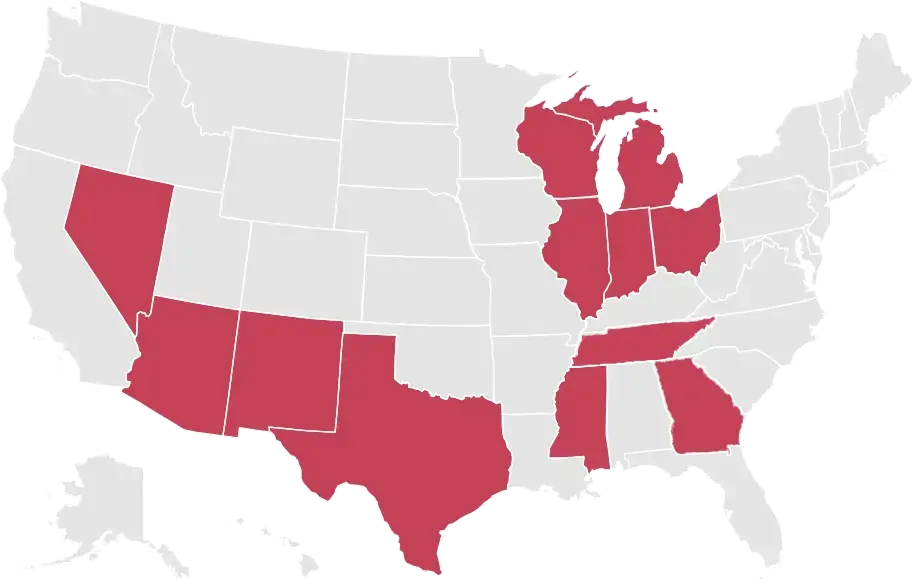

Additionally, unlike the SR-22 certificate, SR-50 is specific to the state of Indiana.

What is SR16?

An SR-16 form is issued to notify the Indiana BMV when a driver has been convicted of violating a motor vehicle law, they fail to appear for a citation, or fail to pay an issued citation. An SR-16 form also notifies the BMV if a suspended driver has been granted Specialized Driving Privileges (SDP), or if any of the above orders have been rescinded.

Non-Owner SR50 Insurance

Non-owner SR-50 insurance is issued to drivers who do not currently own a vehicle, but are required to have an SR-50 certificate to drive legally in the state. It may also be required for individuals to regain their driving privileges after driver’s license suspension.

How Can I Get SR-50?

Call Accurate Auto Insurance at 1-800-999-1034 and speak to one of our customer representatives, or contact us online to get started. We’ll work with your insurance company to ensure that the necessary SR-50 form is filed and received by the Indiana BMV.

One of the Top Car Insurance Companies in Indianapolis

At Accurate Auto Insurance, we’ll help you file your SR-50 certificate quickly, easily, and accurately. Call us today or fill out our online contact form. With help from our car insurance experts, you’ll be back on the road in no time!

If you’re struggling to obtain SR-50 in Indiana for proof of insurance, SR-22, SR-16, or another type of certificate, our team is always here for you.